Biden Takes Aim at the Gig Economy

Gig workers lack safety net protections, while internet-based companies save on labor costs and receive a government bailout.

Prologue

The gig economy is a world in which users rent their labor, spaces and belongings on electronic “platforms.” It’s most often done through an app on your phone that connects workers to customers.

The companies behind these apps–Uber, Lyft, DoorDash, Grub hub, etc.–do not consider themselves employers in the traditional sense, and therefore are relieved of the unspoken covenant that companies meet safety net obligations as a part of an employment contract. No employer, no employee, no contract.

The arrangement would have some kind of appeal to those who eschew the grind of your typical 9-5 full-time employment (or, more likely, can’t find a real job). There’s an obvious appeal to entrepreneurial work where you can make your own hours, “be your own boss.”

Like most everything else, your freedom comes with a risk: less security. Especially when the company you work for doesn’t even acknowledge that you’re an employee.

Biden Reverses Trump’s Independent Contractor Rule

Lat Wednesday, the Biden administration reversed a rule that that Trump’s labor department put in place right before Trump left office in January (please read my article, Scalia’s Revenge.) Trump’s rule, legally questionable, would have made it easier for companies to classify workers as independent contractors, by narrowing the broad definition of “employee” under the Fair Labor Standards Act (FLSA), a 1938 law that sets the rules for work.

It was a promise kept by President Biden, who had written on his campaign website:

Employer misclassification of gig economy workers as independent contractors deprives these workers of legally mandated benefits and protections. This epidemic of misclassification is made possible by ambiguous legal tests that give too much discretion to employers, too little protection for workers and too little direction for government agencies and courts.

Joe Biden campaign

Ride Hailing Apps Get Government Bailout

It’s not just a matter of Uber and Lyft not having to abide by the 40 hour work week or pay overtime, which are key provisions of the FLSA not available to independent contractors.

At the height of the pandemic, when demand for rides slowed to a crawl, drivers were left with little income but could not apply for unemployment benefits because of their classification. The ride hailing companies, because they technically did not have employees, were exempt from paying into the state’s unemployment fund, by an amount, according to a study by the UC-Berkeley Labor Center, exceeding $400 million between the years 2014 to 2019.

The federal government sprang into action by establishing the Pandemic Unemployment Assistance program specifically designed to subsidize gig workers.

Therefore, you can say with conviction that Uber and Lyft got a free ride.

California Leads the Way

So what we have here is a system that’s inherently unfair: Gig companies that hide behind a technology loophole that allows them to circumvent longstanding tenets of capital and labor; and gig workers who are denied simple safety net benefits such as overtime, sick leave, workers compensation, lunch breaks and a health plan that regularly employed (W-2) people are entitled to.

Leave it to California to take a crack at it.

Assembly Bill 5

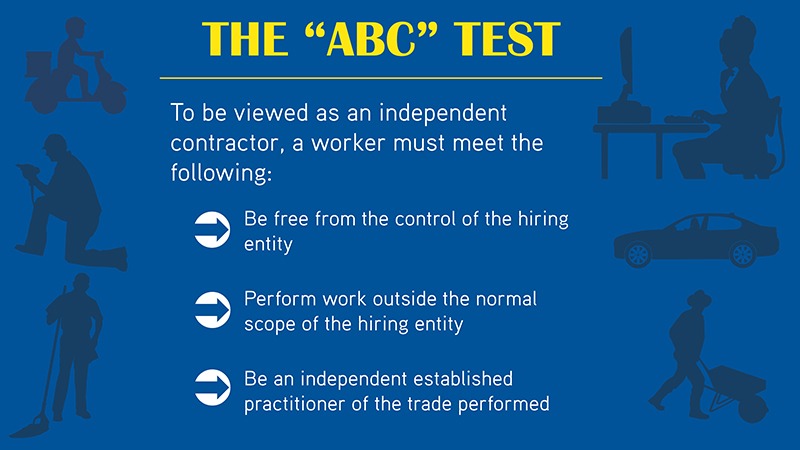

California, the home state of Uber, Lyft and many other technology companies, tried and failed miserably to negotiate better working conditions for its growing number of freelancers, temps and other independent contractors. So its state legislature in 2019 passed Assembly Bill 5, which codified into law a recent California Superior Court decision that most wage-earning workers are employees with the usual labor protections and should be classified as such. It devised a more favorable test (the ABC Test: we’ll get to that) in determining a worker’s employment status.

AB 5 was hailed as “the most progressive labor law enacted in the US in decades.”

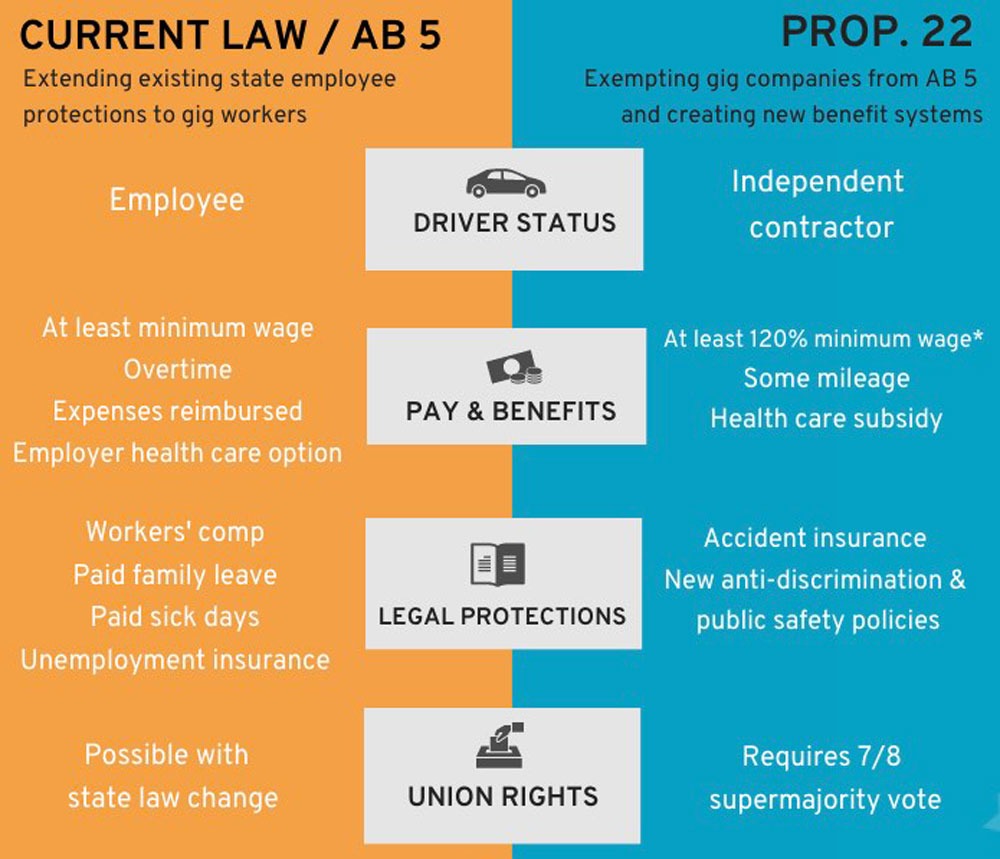

The provisions of AB 5 are summarized in the orange part of the above infographic. The ABC Test provisions are below:

Prop 22

Of course the most progressive labor law in decades did not sit well with affected gig companies. They at first refused to implement it, leading to a flurry of lawsuits and legal judgments.

In the aftermath, Uber, Lyft and DoorDash pooled together over $200 million to place on the ballot Proposition 22, which aimed to exempt firms like Uber and Lyft from classifying gig workers as employees rather than independent contractors. The provisions are summarized on the right (blue) side of the infographic.

Prop 22 turned out to be the costliest ballot measure in California history. Voters passed it by a margin of 59-41%.

Opponents of Prop 22 believe it passed by such a large margin because of the many concessions included in the measure, like the guaranteed minimum earnings, that turned out to be based on “engaged time” and not time waiting for a gig. Proponents made a lot of hay about people wanting to be their own boss. $200 million can make a lot of dreams seem to come true.

Court battles are ongoing to reconcile AB 5 and Prop 22. In the meantime, it’s back on President Biden’s shoulders.

What Biden Can Do for Gig Workers

President Biden’s nullification of the Trump administration’s flagrant disregard for the Fair Labor Standards Act was a solid first step for getting relief for gig workers, whose ranks are growing during this pandemic.

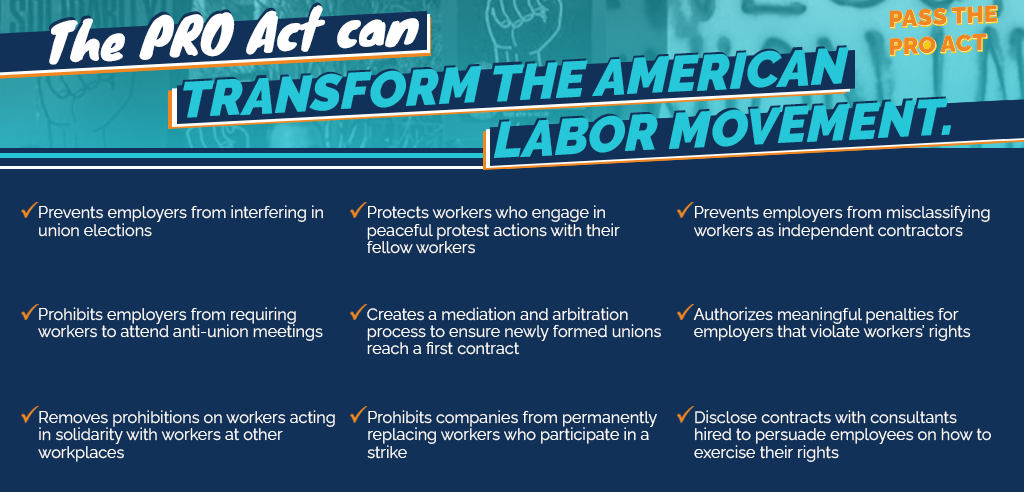

Without the support of Congress, the president cannot singlehandedly enact a federal reclassification law for gig workers like California did (and did not). With the filibuster in place in the US Senate, it’s hard to imagine any proworker legislation getting bipartisan support.

Enforcing the Law

One of Joe Biden’s most important cabinet appointments was secretary of labor. Former mayor of Boston Jack Walsh is a perfect fit for this worker-friendly administration. Walsh “sent massive ripples through the gig economy” by stating he believes gig workers should be classified as employees instead of independent contractors “in a lot of cases.”

Or better yet, actions speak louder than words. Secretary Walsh could start enforcing the FLSA by suing gig companies into compliance with federal labor law. The trade association App-Based Trade Alliance responded by saying they “look forward” to working with Walsh, a positive development.

National Labor Relations Board

Finally, the president could easily make pro-labor appointments to the National Labor Relations Board, unlike the previous administration. Brian Chen, of the National Employment Law Project, predicts the Biden administration will use its power to do whatever it can:

We can expect that a Biden administration will correctly enforce the National Labor Relations Act [to allow gig workers to join unions] and that a Biden administration will act to grant workers overtime and minimum wage under the Fair Labor Standards Act. We can also expect a Biden Equal Employment Opportunities Commission to ensure gig workers have protections against discrimination and harassment that they currently don’t.

Brian Chen

But what about Prop 22’s annulment of some of gig workers basic rights under California law? Not a problem. Federal law reigns supreme.

Make it rain, Mr. President.