GOP Tax Plan: Savaging Medicaid to Transfer Wealth Upward

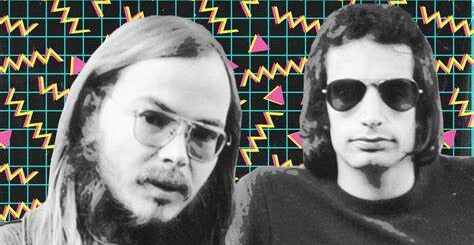

Television actor who played the character Eddie Munster and Speaker of the House Paul Ryan (R-WI). Source: Gawker

Trump’s tax scam would enrich himself and fulfill Paul Ryan’s keg party fantasy

Ah, the kegger in college.

You always knew where the drinkers were: gathered around the keg of beer, priming the pump, wiping away foam, pouring beers, getting happy and buzzed…

Conversations were boisterous and frequently focused on the opposite sex. At one particular keg party, one girl whispered to her friend, ‘he’s cute but he kind of looks like that kid on that old TV show…you know, Eddie Munster.’ Laughter. Her friend responded, ‘But why is he talking about school stuff? So serious. What’s this Medicaid?’ First: ‘Let’s go find some fun guys.’

Drunk Frat Boy Wants to Kick Poor People Off Medicaid

That conversation probably didn’t take place, but this one did: Speaker of the House Paul Ryan conversing with conservative columnist Rich Lowry at a National Review, uh, some annual event we’ll never attend. Asked by Lowry how he would deal with entitlements in light of the president’s campaign promise not to touch them, Delta Tau Delta pledge Ryan answered:

So, Medicaid–sending it back to the states, capping its growth rate. We’ve been dreaming of this since you and I were drinking out of a keg.

Coolness, man!

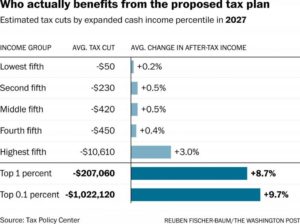

The Rich Get Richer

The US House of Representatives last week passed a budgetary “framework” that probably surpassed Paul Ryan’s wildest (and sudsiest) dreams. It contained all sorts of goodies for the wealthy among us…you know, the folks who don’t need tax relief. Some lowlights:

- Repealing the estate tax. The tax, which averages 17 percent, is paid only on inherited assets greater than $5.3 million. The estate tax will raise about $225 billion in the next 10 years, which would buy a lot of infrastructure repairs (or private jets for Trump cabinet members).

- Repealing the alternative minimum tax, which acts as a loophole repellent for rich people. According to Trump’s 2005 partial tax return obtained by The Rachel Maddow Show, Trump paid $38 million in taxes on $153 million in income. About $31 million of his tax payment was due to the alternative minimum tax. Otherwise, Trump’s tax rate would have been an outrageous 3.5 percent.

- Elimination of the state and local tax deduction. This will put a lot of pressure on state and local governments to lower their taxes, with public education the primary target. Education Reform Now director Michael Dannenburg told Education Week, “the federal government subsidizes all of K-12 public education funding in the form of state and local income, sales and property tax deductions…[This could] decimate public education.”

Paul Ryan’s Foamy Fantasy Takes Step Forward

Senate Minority leader Chuck Schumer: “Not many Americans know that the president and the Republicans are going to try to pay for some of those tax cuts by slashing programs [that] seniors and middle-class Americans rely on.”

Taking a cue from their House colleagues, a current Senate budget resolution “would lead to a $1 trillion cut to Medicaid and a $473 million cut to medicare over the next decade,” according to a staff report. The proposal provides no details on how the cuts will be implemented. Judging by the failed Affordable Care Act repeal, Ryan’s fantasy–“send it back to the states” in the form of block grants–will be the likely method.

This action would rock the foundation of President Trump’s campaign promise, tweeted May 7, 2015, on entitlements: “I was the first & only potential GOP candidate to state there will be not cuts to Social Security, Medicare & Medicaid. Huckabee copied me.”

Reagan and W.: Same Result

Donald Trump seems to be following in the footsteps as his Republican predecessors, Ronald Reagan and George W. Bush. Each enacted tax cuts soon after assuming the presidency and they shared similar results that didn’t meet expectations. Specifically:

- Ronald Reagan, the patron saint of conservatism. He had it good for a while, cutting the marginal rate from its steep 70 percent benchmark. But following Republican losses in the 1982 election and a recession, the deficit ballooned from $700 million to $3 trillion. Something just didn’t make sense about cutting taxes + increasing the military = a balanced budget. Reagan ended up raising taxes eleven times.

- George W. Bush. Remember, Bush inherited a budget surplus from Bill Clinton, but that didn’t last long. In 2001 and 2003, he enacted two massive tax cuts primarily benefiting the rich: People with incomes of over a million dollars stood to gain at least $18,000, which was more than 30 times larger than the cuts enjoyed by average Americans. The Clinton surplus sunk to a deficit of 3.6 percent of GDP in just four years.

The Republican tax plan is predicated on the lie that tax cuts will create jobs and growth. History tells us a far different story.

Tax Cuts Don’t Pay for Themselves

Since he has demonstrated little aptitude or appreciation of history, Donald Trump is not likely to learn from past missteps of Ronald Reagan or George W. Bush. Further, he can safely ignore non-partisan economic research from the likes of the Library of Congress’s Congressional Research Service, which was muzzled by Senate Majority Leader Mitch McConnell for rendering information not to the Republican’s liking. Here is its conclusion, by the way:

The results of the analysis suggest that changes over the past 65 years in the top marginal tax rate and the top capital gains tax rate do not appear correlated with economic growth. The reduction in the top tax rates appears to be uncorrelated with savings, investment and productivity growth. The top tax rates appear to have little or no relation to the size of the economic pie.

However the top tax rate deductions appear to be associated with the increasing concentration of income at the top of the income distribution.