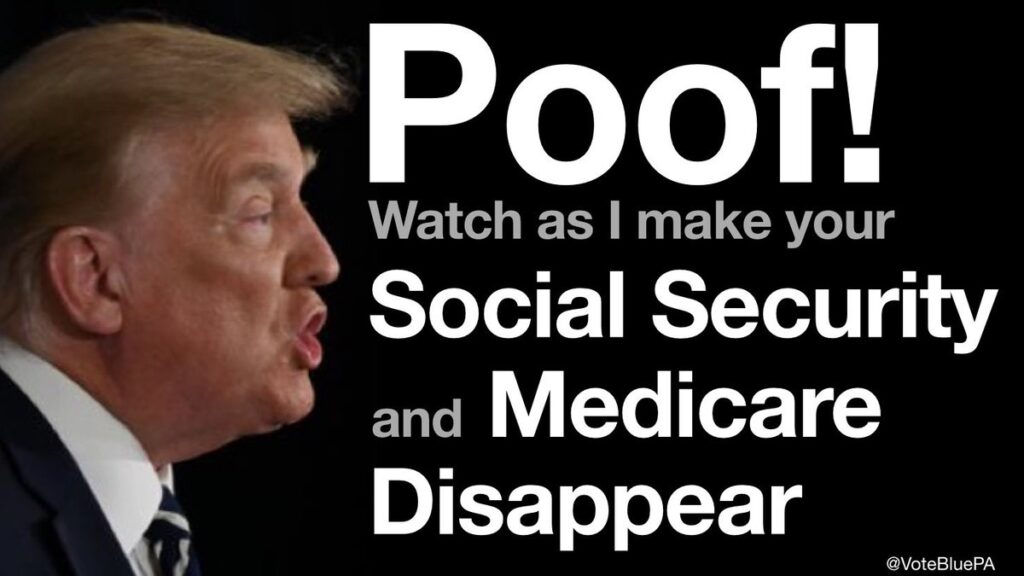

Trump’s Payroll Tax Cut a Covert Attack on Social Security

The president has vowed to permanently shut off the funding spigot for Social Security and Medicare if reelected.

Donald J. Trump sure likes to sign those executive orders, his thick black scrawl resembling, uh, perhaps a rowdy crowd of right wing vigilantes agitating along the bottom of the page. Have you noticed that Trump holds up one of them at the end of his TV commercials? It shows the folks at home that he is the man in charge. Never mind that most of the documents either don’t mean much or would likely be challenged in court.

Exhibit A: With congress at loggerheads over pandemic relief aid, Trump on Aug. 8 signed four executive orders that among other things deferred payroll taxes from Sep. 1 until the end of the calendar year. So what is this payroll tax?

Each time a paycheck is issued, one of the deductions that goes to Uncle Sam is 15.3% of the paycheck’s amount. But only 7.65%–half– is actually deducted from the paycheck. The employer is obligated to cover the exact 7.65% amount out of company funds…in other words, equally share the burden. (Trump’s executive order only pertained to the employee amount.)

So what’s in it for the person lucky enough to still hold a full-time job? If the employee is making $15 an hour, he or she would see an extra $37 a week and $670 by the end of the year. In a pandemic, that’s a pretty slow way to get money into desperate hands.

But hold on. Emphasizing the limitations on presidential authority when it comes to taxes, Trump’s order merely deferred the payroll tax…it didn’t eliminate the tax. Therefore, the tax savings will have to be paid back between Jan. 1, 2021 and Apr. 30, 2021. What was once a small benefit will turn into an unwanted liability.

It’s a whole lot of nothing. No wonder trade groups and the Chamber of Commerce have disclosed that they know of no company that’s actually changing their accounting procedures to implement the deferral.

A Stealth Attack on Social Security?

The payroll tax is the dedicated funding source for Social Security and Medicare. This is how people, based on their earnings, accumulate their retirement funds. And manage their medical costs.

And so here’s the big deal: Trump has vowed to get rid of the payroll tax permanently if he is reelected president. He said so right on tape. Watch Trump’s threat on CNBC Television via YouTube. The reasons he gives are unintelligible, but the intent is clear in one minute, five seconds:

This is in stark contrast to the promises candidate Trump made on the campaign trail in 2015-16, when he bragged that he was the only Republican presidential candidate who would protect Social Security and Medicare. Here is Trump saying as much in a two minute, 43 second video published by the Washington Post via YouTube:

The Consequences

You don’t have to be a math major to understand that if you take away a program’s dedicated funding source, the program is in big trouble. A recent letter sent to congress by Social Security’s chief actuary Stephen Goss estimated that if a payroll tax cut is made permanent, it would deplete Social Security’s funding by mid-2023.

After receiving Goss’s letter, Sen. Chris Van Hollen (D-MD) released this statement: “This analysis makes clear–this is another thinly veiled attempt to gut Social Security and go after the American people’s hard-earned benefits. We can’t let Trump get away with this.”

Trump’s Obsession

Donald Trump has been yapping about cancelling the payroll tax for the better part of the year. He even drew a line in the sand when the big pandemic relief bill was being negotiated…even over loud objections from members of his own party in both the House and the Senate. Trump finally relented, but promised some kind of executive action.

Since payroll tax relief would have only a minor impact on household budgets, there has to be something else driving the president’s fixation on this particular issue? No, I do not have smoking gun proof that Trump wants to eliminate social security. But since Trump lacks a coherent system of beliefs or philosophy, you have to look at who’s talking to him on the phone late at night in the White House residence.

Kitchen Cabinet

The president seems to have a “kitchen cabinet” of economic advisers who as a group date back to the Reagan administration. Perhaps the most famous of these characters is Arthur Laffer, whose “Laffer Curve”–a half-circle allegedly illustrating that lowering taxes would actually increase government revenues–provided a graphic model for supply-side economics.

Laffer swept Ronald Reagan off his feet. Trump was next in line to be duly impressed: last year, he awarded Laffer the Presidential Medal of Freedom. Both presidents turned a blind eye to the reality that supply-side economics has never worked in the real world. My article on the trickle down devastation in the state of Kansas under ex-Governor Sam Brownback is worth perusing.

Laffer’s colleagues among Trump’s economic advisers are conservative activists Steve Forbes and Stephen Moore. Their argument that cutting the payroll tax is good policy: “By reducing the cost of employing someone, and increasing the amount of money workers take home, the cut will make hiring and job-seeking more attractive.”

Never mind the untested, theoretical supply-side thinking. These gentlemen have to know that their proposal eliminates social security’s dedicated funding source.

(Trump recently countered that social security’s revenue base can come out of the government’s general fund. But that would reclassify social security as an entitlement, rather than a record for a lifetime of work. The most popular program in America would be more vulnerable to the deficit hawks.)

Also, to cancel funding for Medicare in a national health emergency is just sheer madness. But then again, the Trump administration has joined 18 attorneys general in asking the Supreme Court to drown the Affordable Care Act.

There’s a saying: If it walks like a duck, talks like a duck…

Of course there is an easier way to avoid this treacherous terrain. We have a chance to get us a new president in less than two months.